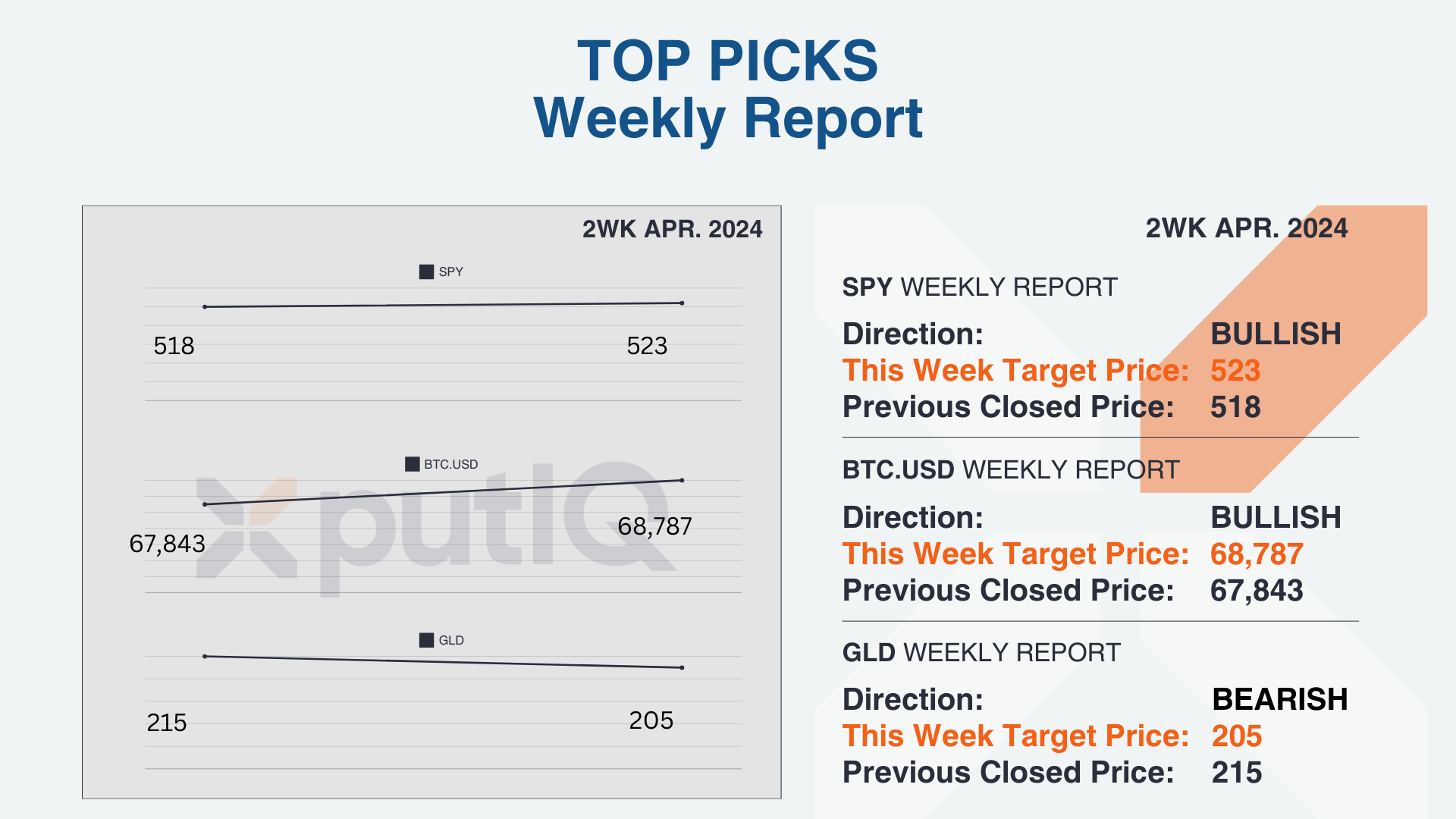

The first week of August saw a muted start to the month, with neutral sentiment prevailing in the SPY and BTC.USD weekly outlooks. The SPY expired neutral, closing at $532.90, marginally above the target price of $532.25, while the BTC.USD also ended neutral, closing at $61,418, slightly above the target price of $61,231. However, gold prices failed to live up to expectations, with the GLD weekly outlook expiring bullish but incorrect, closing at $225.34, below the target price of $226.30. This unexpected turn in gold may spark investor interest, particularly given the notable upper range of $229.94 and lower range of $222.66. Meanwhile, the SPY's upper range of $540.65 and lower range of $523.85, and Bitcoin's upper range of $65,220 and lower range of $57,243, will be key levels to watch in the coming week.

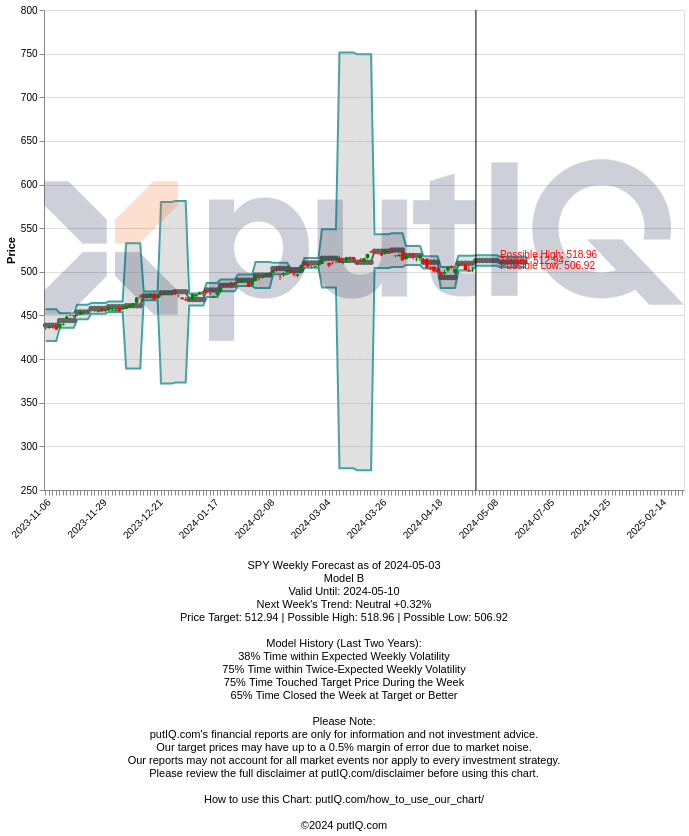

Expired SPY Weekly outlook. 1st WK AUG 2024

> NEUTRAL 📊 CORRECT

Prior Week Closed Price: 532.90

Target Price: 532.25

Strike Price: 532.72 on AUG 9, 2024

Upper Range: 540.65

Lower Range: 523.85

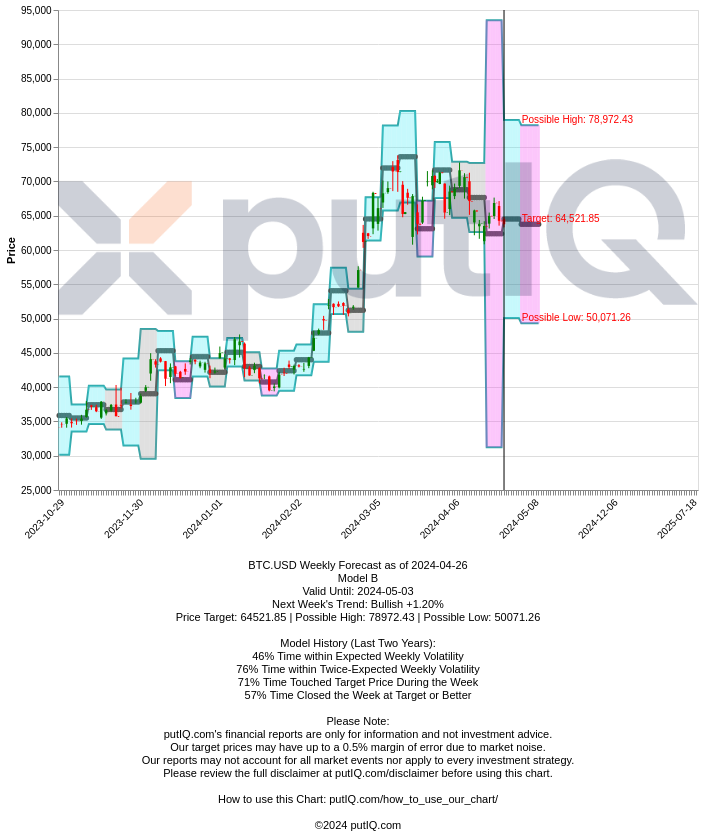

Expired BTC.USD Weekly outlook. 1st WK AUG 2024

> NEUTRAL 📊 CORRECT

Prior Week Closed Price: 61,418

Target Price: 61,231

Strike Price: 61,216 on AUG 9, 2024

Upper Range: 65,220

Lower Range: 57,243

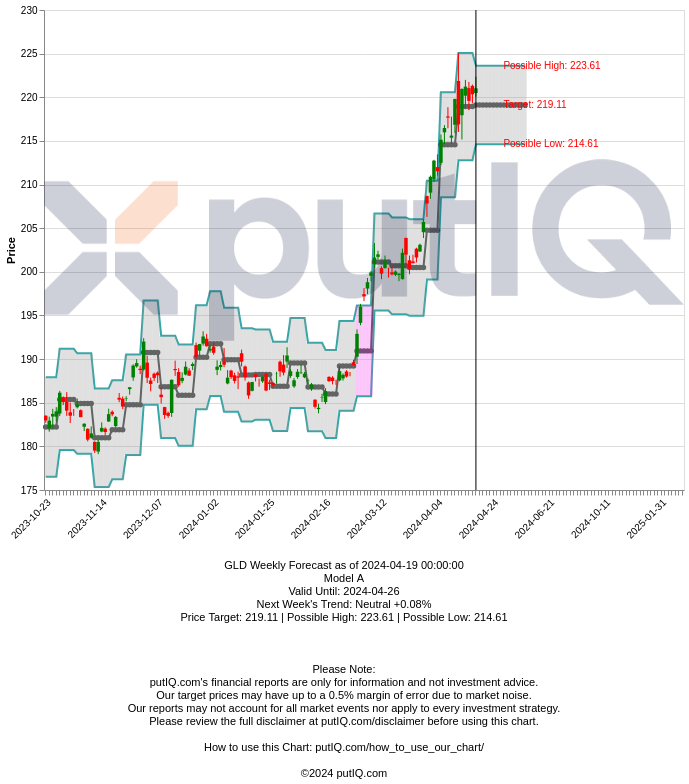

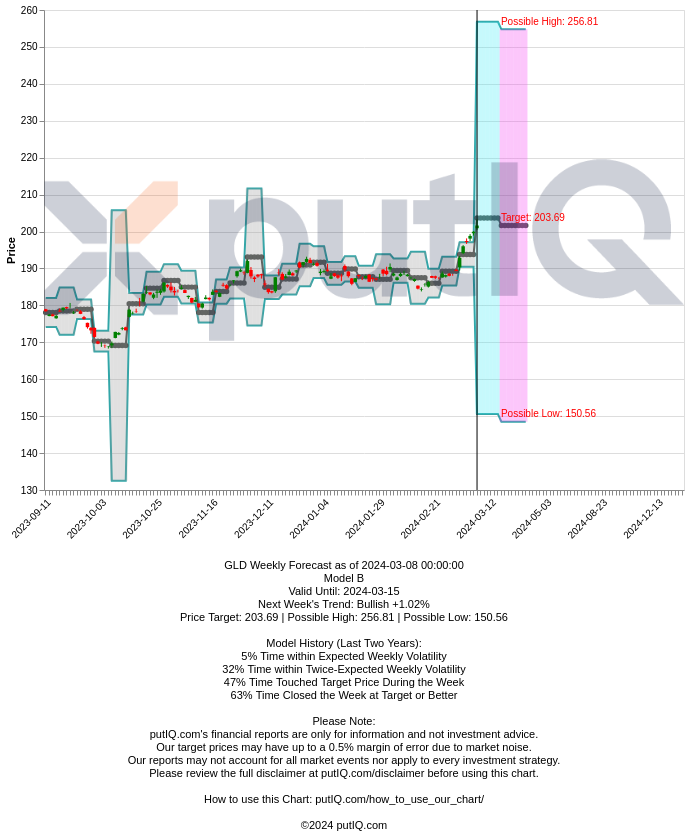

Expired GLD Weekly outlook. 1st WK AUG 2024

> BULLISH 📈 INCORRECT

Prior Week Closed Price: 225.34

Target Price: 226.30

Upper Range: 229.94

Lower Range: 222.66

Expired SPY Weekly outlook. 1st WK AUG 2024

> NEUTRAL 📊 CORRECT

Prior Week Closed Price: 532.90

Target Price: 532.25

Strike Price: 532.72 on AUG 9, 2024

Expired BTC.USD Weekly outlook. 1st WK AUG 2024

> NEUTRAL 📊 CORRECT

Prior Week Closed Price: 61,418

Target Price: 61,231

Strike Price: 61,216 on AUG 9, 2024

Expired GLD Weekly outlook. 1st WK AUG 2024

> BULLISH 📈 INCORRECT

Prior Week Closed Price: 225.34

Target Price: 226.30